Market and Economic Summary

Global equity markets pushed higher during the month of June, largely driven by stronger than expected economic data, which reflected a resilient economy, despite the higher interest rate environment. Hawkish rhetoric from the major global central banks acted as a headwind to the performance of developed market bonds, as markets started to price in that interest rates are likely to stay elevated for longer than previously expected.

US Federal Reserve (Fed) Chair Jerome Powell, announced during the month that the Federal Open Market Committee (FOMC) had decided to leave interest rates unchanged at a level of 5.00% – 5.25%. This marks the first policy meeting at which the FOMC has not raised interest rates, since it began its tightening cycle in March 2022. US inflation data for May (released in June), showed that CPI had slowed to a year-on year rate of 4.0% (from 4.9% year-on-year to the end of April). US core inflation, however, remains elevated, with the year-on-year print to the end of May coming in at a figure of 5.3%.

The UK continues to struggle to come to terms with rampant inflation. May inflation came in at a year-on year rate of 8.7%, while core inflation (excluding volatile food and energy items), rose sharply in May to 7.1% (from 6.8% in April), the highest core inflation rate since March 1992. The Bank of England’s (BoE) Monetary Policy Committee (MPC) raised the main interest rate by 0.5% (the largest increase since February) during June, which increased the rate from 4.5% to 5.0%.

The Chinese economy continues to face headwinds on multiple fronts. The Chinese purchasing manufacturing index (PMI) came in at 49.0 in June (compared to 48.8 in May and 49.2 in April). The data indicates that factory activity for the world’s second largest economy contracted for a third month, while non-manufacturing activity is at its weakest since the reopening of the Chinese economy towards the end of 2022.

South African asset classes all produced positive performance in June, recovering some lost ground after a difficult month in May, as sentiment towards SA focussed equity counters and asset classes improved slightly over the month.

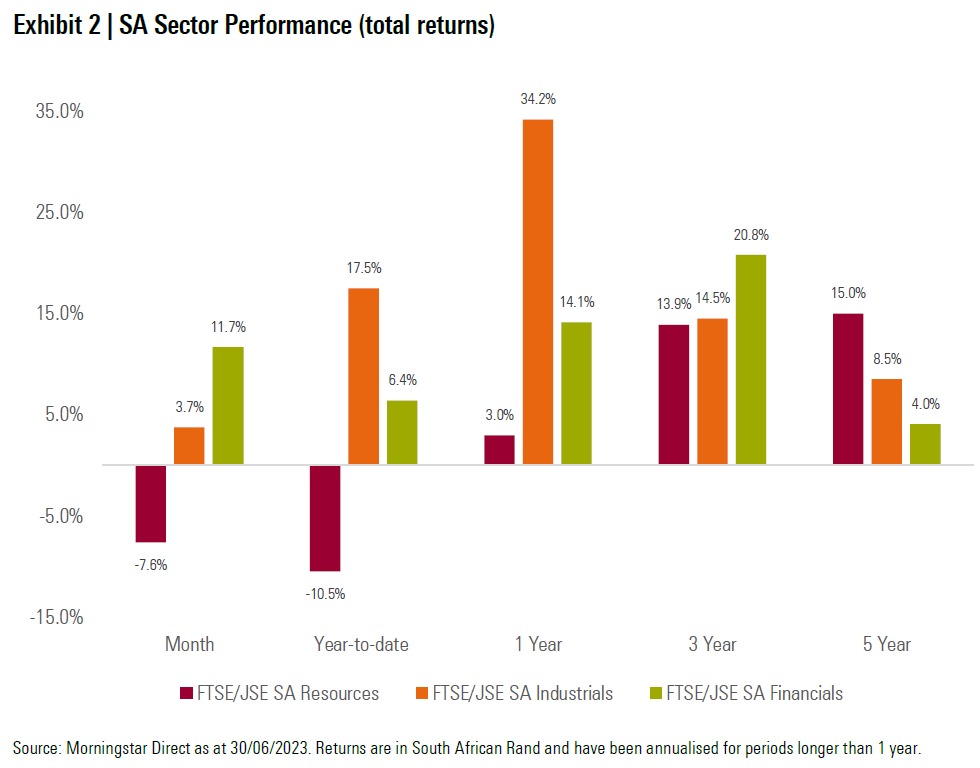

South African equities managed to eke out a positive return for the month, despite a significant divergence in the performance of the different local equity sectors. Financials rebounded strongly, after a difficult May, while the Resources sector came under significant pressure during the month, largely due to weaker commodity prices, particularly for platinum group metals (PGM’s), as well as gold.

Local bonds rebounded strongly during the month, after a difficult May. The asset class reacted positively to improved sentiment from reduced load shedding as well as some positive moves in the local economic outlook, following a difficult start to the year in the first quarter of 2023.

Local property ended the month marginally higher, as there was significant divergence between the performance of the different counters during month. A rebound in some of the index heavy weights, including Resilient (+5.8%) and Redefine (+5.5%), contributed positively to performance, while Growthpoint (-0.3%) ended the month marginally lower.

Economic data for April (which was released in June) showed a recovery in the SA economy at the start of the second quarter after a difficult start to the year, despite ongoing challenges posed by the unstable electricity supply. SA’s economic growth for the first quarter of 2023 slowed to 0.2% year-on-year, the slowest pace of growth since a contraction in the first quarter of 2021.

South Africa’s annual headline inflation rate continued its downward trend during the month of May, coming in at a year-on-year rate of 6.3% (from 6.8% in April). The drop in headline inflation over the month was largely due to a significant fall in food inflation, which contributed 0.4% of the 0.5% overall fall in the headline inflation rate over the month.

Consumer and business confidence in SA continues to be depressed, with both facing severe headwinds from the steep interest rate hiking cycle from the South African Reserve Bank (SARB), the higher cost of living, the unstable electricity supply and increased geopolitical risks following government missteps.

Most of the major developed equity markets ended the month higher, driven by robust economic data, which mostly came in ahead of expectations. The MSCI World Index delivered a return of +6.1%, which was ahead of its emerging market peers.

Emerging markets also delivered strong performance for the month, despite lagging developed market peers slightly. The MSCI Emerging Markets Index ended the month +3.9% higher in June.

Most of the major global equity markets produced positive returns in June. Germany’s FSE DAX (+5.5%), The UK’s FTSE 100 (+4.0%) and Japan’s Nikkei 225 (+4.0%) all ended the month higher. China’s Shanghai SE Composite (-2.3%) was one of the few major global equity markets to end the month in negative territory, as investors came to terms with weak economic data releases during the month.

US equities delivered strong performance during the month. The tech-heavy NASDAQ 100 (+6.6%) ended the month significantly higher, as the large cap technology and communication services companies continue to drive the US market higher. The S&P 500 (+6.6%) also ended the month higher.

Impact on Client Portfolios

From a portfolio perspective, investors managed to generate positive returns from portfolios during the month of June. Sentiment towards South African focussed equity counters and asset classes improved slightly over the month, which led to a strong rebound in the local bond market, as well as some “SA Inc” counters listed on the JSE. Global equity markets generated strong hard currency returns, as better than expected economic data drove markets higher. The rand did act as a headwind to the performance of global allocations, as the local unit recovered some lost ground against the major crosses during the month.We remain comfortable with the current positioning of client portfolios, both from an asset allocation and a manager selection perspective. We will continue to follow our valuation-driven approach by allocating assets to the most attractive areas of the market from a reward-for-risk perspective and ensure we build robust portfolios. We are confident that we will continue to deliver on the specific investment objectives of each client portfolio independent of the prevailing market environment.

About the Morningstar Investment Management Group

Morningstar’s Investment Management group, through its investment advisory units, creates investment solutions that combine award-winning research and global resources with proprietary Morningstar data. Morningstar’s Investment Management group provides comprehensive retirement, investment advisory, and portfolio management services for financial institutions, plan sponsors, and advisers around the world.Morningstar’s Investment Management group comprises Morningstar Inc.’s registered entities worldwide including: Morningstar Investment Management LLC; Morningstar Investment Management Europe Limited; Morningstar Investment Management South Africa (Pty) Ltd; Morningstar Investment Consulting France; Ibbotson Associates Japan, Inc; Morningstar Investment Adviser India Private Limited; Morningstar Investment Management Asia Ltd; Morningstar Investment Services LLC; Morningstar Associates, Inc.; and Morningstar Investment Management Australia Ltd.About Morningstar, Inc.

Morningstar, Inc. is a leading provider of independent investment research in North America, Europe, Australia, and Asia. The company offers an extensive line of products and services for individual investors, financial advisors, asset managers, retirement plan providers and sponsors, and institutional investors in the private capital markets. Morningstar provides data and research insights on a wide range of investment offerings, including managed investment products, publicly listed companies, private capital markets, and real-time global market data. The company has operations in 27 countries.

Important Information

The opinions, information, data, and analyses presented herein do not constitute investment advice; are provided as of the date written; and are subject to change without notice. Every effort has been made to ensure the accuracy of the information provided, but Morningstar makes no warranty, express or implied regarding such information. The information presented herein will be deemed to be superseded by any subsequent versions of this document. Except as otherwise required by law, Morningstar, Inc or its subsidiaries shall not be responsible for any trading decisions, damages or losses resulting from, or related to, the information, data, analyses or opinions or their use. Past performance is not a guide to future returns. The value of investments may go down as well as up and an investor may not get back the amount invested. Reference to any specific security is not a recommendation to buy or sell that security. There is no guarantee that a diversified portfolio will enhance overall returns or will outperform a non- diversified portfolio. Neither diversification nor asset allocation ensure a profit or guarantee against loss. It is important to note that investments in securities involve risk, including as a result of market and general economic conditions, and will not always be profitable. Indexes are unmanaged and not available for direct investment.

This commentary may contain certain forward-looking statements. We use words such as “expects”, “anticipates”, “believes”, “estimates”, “forecasts”, and similar expressions to identify forward-looking statements. Such forward- looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially and/or substantially from any future results, performance or achievements expressed or implied by those projected in the forward-looking statements for any reason.

The Report and its contents are not directed to, or intended for distribution to or use by, any person or entity who is not a citizen or resident of or located in any locality, state, country or other jurisdiction listed below. This includes where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Morningstar or its subsidiaries or affiliates to any registration or licensing requirements in such jurisdiction.

The Report is distributed by Morningstar Investment Management South Africa (Pty) Limited, which is an authorized financial services provider (FSP 45679), regulated by the Financial Sector Conduct Authority.